2021 Plan Overview

Looking for 2020 plans? Click here.

No Referrals

For Specialists

Freedom of choice:

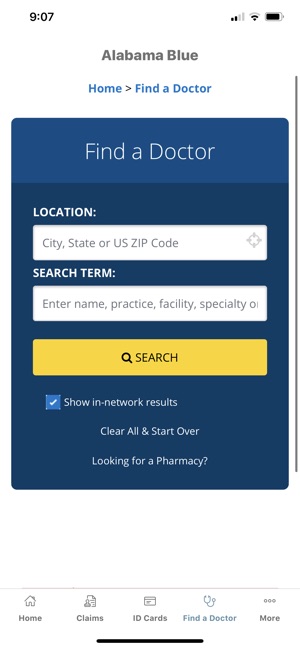

- Concerned your provider choices may be limited with C Plus? Don’t be!

You have access to a large network in Alabama — with over 90% of all doctors and 100% of all hospitals. - No referrals needed for specialists!

- If you’re TRAVELING outside of Alabama ...

You're free to use any doctor or hospital that accepts Medicare — anytime, anywhere.

If Medicare pays, C Plus pays!

$40 copay for 1st three illness related office visits; thereafter plan pays 100% after Deductible. Blue Cross and Blue Shield of Alabama is an independent licensee. Recent tornadoes have caused widespread damage and adversely affected many Blue Cross and Blue Shield of Alabama members. If you have been affected by these tornadoes and have questions, you can call customer service at 1-855-745-0831. Blue Advantage Premier (PPO) H0104-015 is a 2021 Medicare Advantage Plan or Medicare Part-C plan by Blue Cross and Blue Shield of Alabama available to residents in Alabama. This plan includes additional Medicare prescription drug (Part-D) coverage. The Blue Advantage Premier (PPO) has a monthly premium of $170.00 and has an in-network Maximum.

C Plus benefits include:

Blue Cross Blue Shield Of Alabama Copays And Deductibles

- $0 copays for Medicare-eligible in-network doctor visits, outpatient hospital stays and emergency room visits after meeting your Part B deductible

- Medicare-eligible inpatient hospital stays – covered in full

Enjoy a complimentary SilverSneakers® fitness membership!

A fun and innovative health, exercise and wellness program for active, older adults. Use it to get fit, have fun and make new friends while enjoying a healthy lifestyle. Your membership includes:

- Unlimited access at nearly 300 participating locations in Alabama

- At-home kits if you can't get to a fitness location due to health reasons

- Online resources and support from trained Advisors

C Plus can be combined with BlueRx℠, a Medicare-approved Part D Plan.

Original Medicare | C Plus | C Plus | C Plus | |

| Part A Hospital Expenses | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

|---|---|---|---|---|

| Initial Part A Hospital Deductible | $1,408 | $0 | $0 | $0 |

| Daily Copay For Days 61-90 In A Hospital | $352 per day | $0 | $0 | $0 |

| Daily Copay For Days 91-150 In A Hospital | $704 per day | $0 | $0 | $0 |

| Additional 365 Days Once Lifetime Reserve Days Are Used | All costs | $0 | $0 | $0 |

| Daily Copay For Days 21-100 In A Skilled Nursing Facility | $176 per day | $176 per day | $0 | $0 |

| Part B Physician Services & Supplies | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

| Annual Part B Deductible | $198 | $198 | $198 | $0 |

| Doctor and specialist visits | 20% | $0 | $0 | $0 |

| Lab and X-ray | 20% | $0 | $0 | $0 |

| Outpatient services and procedures | 20% | $0 | $0 | $0 |

| Durable medical equipment | 20% | $0 | $0 | $0 |

| Other Part B services | 20% | $0 | $0 | $0 |

| Other Benefits Not Covered by Medicare | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

| Medically Necessary Emergency Care Services During The First 60 Days Of Each Trip Outside the United States | All costs | All costs | $250 deductible, then 20%, and all costs over $50,000 | $250 deductible, then 20%, and all costs over $50,000 |

Original Medicare | C Plus | C Plus | C Plus |

Original Medicare | C Plus | C Plus | C Plus | |

| Part A Hospital Expenses | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

|---|---|---|---|---|

| Initial Part A Hospital Deductible | $1,408 | $0 | $0 | $0 |

| Daily Copay For Days 61-90 In A Hospital | $352 per day | $0 | $0 | $0 |

| Daily Copay For Days 91-150 In A Hospital | $704 per day | $0 | $0 | $0 |

| Additional 365 Days Once Lifetime Reserve Days Are Used | All costs | $0 | $0 | $0 |

| Daily Copay For Days 21-100 In A Skilled Nursing Facility | $176 per day | $176 per day | $0 | $0 |

| Part B Physician Services & Supplies | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

| Annual Part B Deductible | $198 | $198 | $198 | $0 |

| Doctor and specialist visits | 20% | $0 | $0 | $0 |

| Lab and X-ray | 20% | $0 | $0 | $0 |

| Outpatient services and procedures | 20% | $0 | $0 | $0 |

| Durable medical equipment | 20% | $0 | $0 | $0 |

| Other Part B services | 20% | $0 | $0 | $0 |

| Other Benefits Not Covered by Medicare | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

| Medically Necessary Emergency Care Services During The First 60 Days Of Each Trip Outside the United States | All costs | All costs | $250 deductible, then 20%, and all costs over $50,000 | $250 deductible, then 20%, and all costs over $50,000 |

Original Medicare | C Plus | C Plus | C Plus |

Original Medicare | C Plus | C Plus | C Plus | |

| Part A Hospital Expenses | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

|---|---|---|---|---|

| Initial Part A Hospital Deductible | $1,408 | $0 | $0 | $0 |

| Daily Copay For Days 61-90 In A Hospital | $352 per day | $0 | $0 | $0 |

| Daily Copay For Days 91-150 In A Hospital | $704 per day | $0 | $0 | $0 |

| Additional 365 Days Once Lifetime Reserve Days Are Used | All costs | $0 | $0 | $0 |

| Daily Copay For Days 21-100 In A Skilled Nursing Facility | $176 per day | $176 per day | $0 | $0 |

| Part B Physician Services & Supplies | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

| Annual Part B Deductible | $198 | $198 | $198 | $0 |

| Doctor and specialist visits | 20% | $0 | $0 | $0 |

| Lab and X-ray | 20% | $0 | $0 | $0 |

| Outpatient services and procedures | 20% | $0 | $0 | $0 |

| Durable medical equipment | 20% | $0 | $0 | $0 |

| Other Part B services | 20% | $0 | $0 | $0 |

| Other Benefits Not Covered by Medicare | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

| Medically Necessary Emergency Care Services During The First 60 Days Of Each Trip Outside the United States | All costs | All costs | $250 deductible, then 20%, and all costs over $50,000 | $250 deductible, then 20%, and all costs over $50,000 |

Original Medicare | C Plus | C Plus | C Plus |

What Is The Copay For Blue Cross Blue Shield

Original Medicare | C Plus | C Plus | C Plus | |

| Part A Hospital Expenses | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

|---|---|---|---|---|

| Initial Part A Hospital Deductible | $1,408 | $0 | $0 | $0 |

| Daily Copay For Days 61-90 In A Hospital | $352 per day | $0 | $0 | $0 |

| Daily Copay For Days 91-150 In A Hospital | $704 per day | $0 | $0 | $0 |

| Additional 365 Days Once Lifetime Reserve Days Are Used | All costs | $0 | $0 | $0 |

| Daily Copay For Days 21-100 In A Skilled Nursing Facility | $176 per day | $176 per day | $0 | $0 |

| Part B Physician Services & Supplies | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

| Annual Part B Deductible | $198 | $198 | $198 | $0 |

| Doctor and specialist visits | 20% | $0 | $0 | $0 |

| Lab and X-ray | 20% | $0 | $0 | $0 |

| Outpatient services and procedures | 20% | $0 | $0 | $0 |

| Durable medical equipment | 20% | $0 | $0 | $0 |

| Other Part B services | 20% | $0 | $0 | $0 |

| Other Benefits Not Covered by Medicare | With Medicare alone YOU PAY: | With Plan B YOU PAY: | With Plan G YOU PAY: | With Plan F YOU PAY: |

| Medically Necessary Emergency Care Services During The First 60 Days Of Each Trip Outside the United States | All costs | All costs | $250 deductible, then 20%, and all costs over $50,000 | $250 deductible, then 20%, and all costs over $50,000 |

Original Medicare | C Plus | C Plus | C Plus |

Blue Cross Blue Shield Medicare Supplement

†IMPORTANT NOTE: C Plus Plan-F Qualification

Starting in 2020, the popular Plan-F will only be available to those who are Medicare eligible by 12/31/19 (either by age, disability or previously qualified and still working beyond age 65). Questions? Call 1-855-828-3982 (TTY 711).

**SilverSneakers is a registered trademark of Tivity Health, Inc. © Tivity Health, Inc. All rights reserved.

Blue Cross Blue Shield Medicare Advantage

This is a solicitation of insurance. Contact may be made by an issuer or insurance producer or another acting on behalf of the issuer or producer. C PlusSM is a Medicare Select plan and is a private insurance plan regulated by the Alabama Department of Insurance. It is not connected with or endorsed by the U.S. government or the federal Medicare program.